When it comes to buying a home, understanding your credit score is crucial. For most lenders, your FICO Score is one of the most important factors in determining your loan eligibility and interest rates. But how is this score calculated, and what does each part mean for you? Here, we break down the components of your FICO Score to give you a clearer picture of how lenders assess your credit.

The Five Key Factors in Your FICO Score

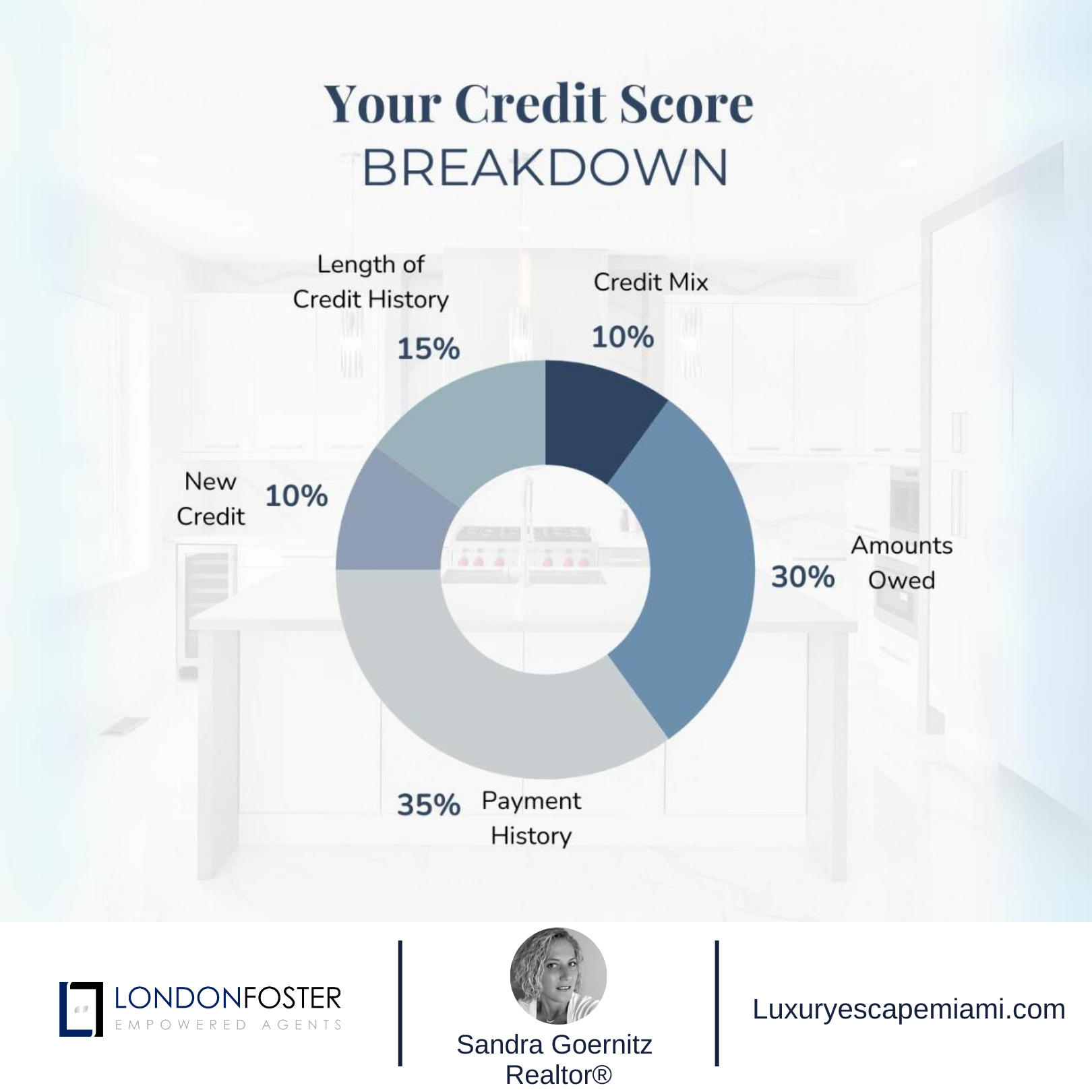

Your FICO Score is determined by five main factors, each carrying a different level of importance in the scoring model. These factors help lenders gauge the risk of lending to you and range from your payment history to the types of credit you have. Let’s go through each one:

Payment History (35%)

This is the most critical part of your FICO Score, comprising 35% of the calculation. Lenders prioritize knowing whether you’ve paid your bills on time because it’s a strong indicator of your likelihood to repay future debts. Late payments, collections, or bankruptcies can significantly impact this part of your score.

Amounts Owed (30%)

Owing money on your accounts is typical, but using a large portion of your available credit can indicate financial strain, which lenders may see as a higher risk of default. If you’re consistently close to your credit limits, this could lower your score. Aim to keep balances low relative to your available credit to optimize this part of your score.

Length of Credit History (15%)

A longer credit history generally improves your FICO Score. This part of the score considers how long your accounts have been active, including the ages of your oldest, newest, and average accounts. If you’re relatively new to credit, building a longer history takes time but can pay off in the long run.

Credit Mix (10%)

Your FICO Score benefits from a varied credit profile that includes a mix of credit cards, retail accounts, installment loans, and possibly even a mortgage. While it’s not necessary to have each type, having diverse credit sources shows lenders you can responsibly manage different kinds of debt.

New Credit (10%)

Opening several credit accounts within a short timeframe can signal risk to lenders, especially if you have a short credit history. Each new credit application typically results in a hard inquiry, which can slightly impact your score. Try to avoid unnecessary credit inquiries before a major purchase, like a home.

Why Credit Scores Vary from Person to Person

Credit scoring isn’t a one-size-fits-all model. The impact of each factor can differ based on individual credit profiles. For instance, someone with a shorter credit history may see the “length of credit history” factor weigh more heavily in their score than someone with years of established credit. Furthermore, as your credit report updates regularly, the weight of these factors can shift over time. This dynamic quality means that improving one part of your credit profile, like payment history, can have evolving effects on your overall score.

What FICO Scores Do (and Don’t) Consider

FICO Scores focus exclusively on what’s in your credit report. Factors such as your income, employment history, and current job stability, while important to lenders, are not considered in your FICO Score itself. When you apply for a mortgage, lenders may review these additional aspects, so even a strong credit score isn’t a guarantee of loan approval.

What Is Ignored in FICO Score Calculations?

Certain types of personal information are left out of FICO calculations. Here are a few things FICO Scores ignore:

- Age and gender

- Employment history (such as your occupation or salary)

- Geographical location

This ensures that the FICO Score remains focused solely on financial responsibility, not personal characteristics.

How to Strengthen Your Credit Score for Your Home Purchase

Improving your credit score takes time and effort, but a few strategies can help you get started:

- Pay your bills on time to improve payment history.

- Reduce outstanding balances on credit cards and loans.

- Avoid opening new accounts in the months leading up to your mortgage application.

Building and maintaining a good credit score can make all the difference in the home-buying process. By understanding the elements that make up your FICO Score, you’ll be better equipped to take steps that can positively impact your financial future.